What is it and is it about to pop?

As this website references both banking and backpacking, I felt it was time to write my first financially themed article.

Firstly, let me address the recent stock market crashes around the world due to "Coronavirus (COVID19)". The closing down of economies and countries has and will continue to cause devastation on multiple levels, but the virus is not the cause but a catalyst of collapsing stock markets. People in power will blame the virus to deflect and detract their responsibility in creating the biggest bubble humanity has ever seen. The collapse had begun behind the scenes before the virus reared its ugly head.

A theory that the virus was not an accident has some merit in my opinion. Coincidences with such huge global implications rarely happen by chance. Not a single pandemic since 1918 with higher fatalities and infection rates has ever caused global country shutdowns....that would however be the subject of a whole different article!

The last crash of 2008 was a US$30 trillion bubble, the tech crash of 2000 a US$15 trillion bubble......this everything bubble is around

US$250 trillion by comparison, 8 to 16 times bigger. We have come to the end of an era of fake stock markets, fake property prices, fake mainstream media news and most importantly, fake fiat money.

So what is the everything bubble?

A bubble in financial terms, refers to an asset that has been inflated in price to a point that no longer makes sense and is not based on market fundamentals.

Let's go back in time to The Dutch Tulip Bubble from the mid 1600s as an example. During this time, a single tulip bulb, a flower, was worth the same as a home.....yes a whole house. Tulip mania had taken hold and swept throughout Holland.

Clearly this was not based on any form of reality, but investors, or better yet, let's call them speculators, were sucked in, hoping to realize surreal profits and get out before the next person. Many were aware it was a bubble, but took the risk regardless, as the stories of becoming super rich, reached fever pitch. At the time, the price of bulbs could only go up in the eyes of everyone......until the bubble burst, and most were left with nothing.

A similar story before the great depression of the 1930s, is said to go something like this.

A Wall Street Stockbroker was having his shoes polished by a shoe shine boy on a street corner, the boy then proceeded to give the stockbroker share tips! The current bubble may not seem as crazy or extreme, but it is likely to affect more people, ordinary people. The working and middle classes, investors, homeowners, pensioners and anyone who is fortunate to have savings in one form or another.

This Everything Bubble includes: property, stocks, bonds, artworks, fine wine, classic cars, modern hyper-cars (if ever there was a truer term!) and yachts etc.

All these assets have increased in value disproportionately in recent years – I believe things have begun to change.

History

All asset classes go through multiple up-cycles of rising prices and subsequently down-cycles, with price reductions or crashes. This was particularly true in the 2008 crash, where property values plummeted in most countries, due to the sub-prime loan scandal.

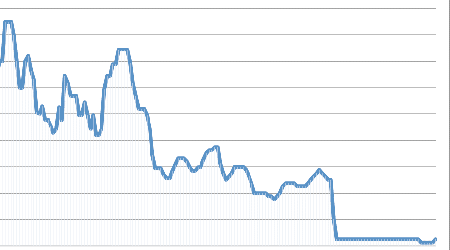

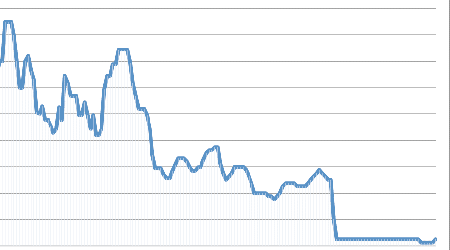

Stock markets are historically prone to cycles every 7-8 years. We have now passed over 12 years since the last crash. Many experts believe we are severely overdue a correction.

Many of us have selective memories and choose not to remember that during the last two recessions, investors lost around 50% of their wealth. Most investors and the general public, believe market corrections are irrelevant. The vast majority believing that ultimately, stocks and houses will continue to rise in value when looked at over a long period of time.

To some extent this has proved accurate and is the advice investors receive from financial magazines, newspapers and stockbrokers. They always recommend to continue keeping your money in the stock market and ride out the storms. But is this actually true?

Having worked for 18 years in both Investment Banking and Asset Management, the number one aim of these companies is to keep your money invested with them. The fees they charge are based on the total amount of money that is invested with them and control.

If a significant proportion of this money were withdrawn, they would struggle to survive. They would have to lay off staff and sell or sub-rent the office space they have taken out long-term leases on, which is always in the most expensive locations around the world.

So of course, they create all sorts of marketing material, glossy brochures and multimedia presentations with a multitude of charts to convince investors and in particular, pension funds to stay invested in the stock market, their actual existence depends on this. How do I know this? I worked in marketing for these institutions.

It doesn't matter if performance is up or down, articles will be written to convince investors to stay invested.

You might think, okay, if performance is down during one or two quarters it doesn't really matter. But what happens when performance is down for 2, 3 or even 5 years and articles are still being written to convince the pension funds to stay. Remember, pension funds are a pool of the money of ordinary people like you and me, our monthly payments go towards these pension funds to fund our retirement. I will be writing an article about pension funds in the future.

As I often tell people, the 2008 global crash was just the starter/appetizer course. The problems that caused the 2008 crash were never solved but instead the can has been kicked down the road for the past 12 years. We have yet to experience the main course of a global crash that will make 2008 look like a mere blip. The next crash is likely to dwarf the Great Depression of the 1930s, unfortunately, it will be very ugly. Some alternative financial analysts are predicting stock market crashes of up to 80-90%.....recent huge crashes could merely be the beginning.

The Federal Reserve and other central banks around the world have been propping up stock markets for the past 12 years. Ask yourself, why have they needed to do this if economies were healthy rather than on the verge of collapse?

There will be a point when stock markets function normally, unlike the past 12 years, and reflect reality where there will be no buyers for stocks, bonds and other financial products as they reflect their real value and not the induced bubble by central banks around the world.

If you have any doubts that this is true, a recent University study showed that 93% of the US Stock Market rise is directly attributable to interference by the US Federal Reserve.

At the beginning of the 2008 crash, the top global investment banks of the world ran to the US Government asking it to prop up the financial system. We were told, it was to the tune of billions of dollars, the truer undisclosed number was in the trillions. It's hard to even think how many zeros that is.

This money was supposed to be used by the banks to lend to businesses, particularly SMEs (small & medium enterprises), and push economies forward. Instead, most of this money stayed with the big investment banks and only went to some very large corporations and not the small "mom & pop" enterprises. When you look at the statistics, SMEs, account for approximately 90% of jobs and therefore the force that powers economies forward in most countries.

Presently in March 2020, The Federal Reserve is up to its old tricks yet again, pumping trillions of US dollars to its friends within the Investment Banking & Hedge Fund industries. The recent dramatic stock market collapses have exposed these institutions and how The Federal Reserve gives priority to its friends and owners on Wall Street over small businesses and

ordinary people on Main Street. It may surprise you to learn that The Federal Reserve is not Federal and not part of the US Government, but a privately owned institution.

The central banks of the world; The Bank of England, The Federal Reserve, The European Central Bank, and The Bank of Japan have been printing lots of money for over a decade. This money printing or quantitative easing as they refer to it, had the consequence of exploding asset prices but also devaluing the money in circulation.

Stock markets have increased substantially over the past 12 years by this artificial propping up of global economies. On the surface and by that I mean, in the mainstream media – the televised news and newspapers, the economies and health of most countries seem to be doing very well. But economies globally are overdue a massive correction.

In reality, SMEs in particular, are struggling as they are unable to raise finance to help with future growth.

The lowest interest rates we have seen for the last 5,000 years, have also led to corporations borrowing billions upon billions very cheaply. Much of this money has gone into property in many countries around the world. This is sometimes referred to as the Skyscraper Index.

Many of us have witnessed an extraordinary number of cranes in big cities with companies building apartments everywhere they can. This has certainly been true during the 14 months I spent in South East Asia.

All the big cities are building like crazy; Singapore, Kuala Lumpur, Bangkok, Phnom Penh, Manila and Jakarta.

This is one consequence of cheap money, big businesses borrow big money to convert into large profits. There is only one problem, property globally is in an oversupply situation with a few exceptions, notably Singapore and Hong Kong.

As individuals, we have also taken advantage of low interest rates to borrow more in the form of loans and mortgages which have attractive low monthly payments. This has led to massive levels of consumption mostly through credit cards but also people re-mortgaging their homes in order to invest in further properties to rent out. Pension annuity levels have decreased substantially over the past two decades, leading pensioners to seek alternative higher yielding returns, unfortunately with higher risk levels. It is no coincidence that personal debt worldwide is at its highest level for 20 years. Having too much personal debt never ends well, especially when an economy goes into a decline and people begin to lose their jobs.

We have also been experiencing negative interest rates for the longest period since records began. The result is that it's not worth putting your money into a bank as they are charging you to look after it.

While on the surface for those taking out a mortgage, negative interest rates are a boon, as you can buy a property with the lender charging very low rates for the loan. The lenders only need to raise interest rates by 2-3% and hundreds of thousands, if not millions of homeowners will be repossessed.

We also have the crazy situation with some countries issuing 20-30 year bonds which do not pay the investor any interest at all. Let that sink in, you hand over your hard-earned money to your government with zero return for 20-30 years.

Corporate buybacks (where companies buy back their own shares) have been used by senior management to give themselves huge bonuses based on a rising share price as fewer shares are in circulation. This is another reason that stock markets are at an all-time high. Apart from a few huge corporations, the majority are less profitable than in the past, they appear healthy but are far from it because they are not investing for future growth. In fact, some of the biggest (Apple, Microsoft & Berkshire Hathaway) are hording cash as they know what is about to happen and will go on a buying spree to snap up companies for a fraction of their current share price once stock markets crash.

There are many companies that should no longer be trading based on market fundamentals. Tesla, were it not for hundreds of billions of dollars in government subsidies, doesn't really have a viable business model. Somehow it is more valuable than all the major US vehicle manufacturers combined! Financial analyst's are now speaking up about this.

Another metric used to determine how healthy large corporations are, is to look at the likelihood of them paying back borrowed money. Prior to the 2008 crash – 35% of investment-grade corporate bonds, as they are known, were rated BBB, which is just one level above junk status. Presently that number is 50%.

Deutsch Bank has shed 10,000s of employees globally and could be on the verge of collapsing. It has a derivatives position (bets), valued at €45 trillion....with a "t" not "b" as in billions. This equates to 12 times the output of the whole German economy in one year.....what could possibly go wrong?

If the bank were due to collapse, I'm sure the German government would come in and save the day simply because the bank is named after Germany! Another bank that has similar problems is HSBC. These are a couple of the big boys in banking, many less well known banks are equally in trouble, which one will be the next Lehman Brothers (where I spent many years, prior to them being taken out) remains to be seen.

IPOs (Initial Public Offerings), where a company is placed onto a stock market for the first time, are popular again. Uber and Lyft were recent floats, with Airbnb set to launch later in 2020. One problem, just like the previous tech bubble, most of these companies are losing tons of money.....billions per year. The private investors that put billions upon billions into these companies want their money back. The only way to do this, is to float these businesses on stock markets before they crash and lose all their investment.

Uber has been losing billions every year since it started as it has to give huge incentives to drivers, leading to huge losses in developing new markets.

We also have fake beef, a company that has created artificial beef in a laboratory that has US$29 million in profits but valued at a crazy US$39 billion.

The historic way of sorting the good companies from the bad, was abandoned a long time ago, with traditional accounting standards ignored. This will end in the same way as the Tech Crash (dot-com bubble) of 2000.

The situation in Japan is farcical. The Japanese Government owns over 5% of the Nikkei Stock Market. In other words, it is the top shareholder in over 23 companies, this is close to 40% of all listed companies on the Nikkei. This is not based on any form of economic reality and likely not last for much longer, despite having been in place for the past 10 years.

Many retailers are closing their doors and shutting down at shocking rates. Macy's alone will be closing 125 locations, cutting 2,000 jobs, they are not alone, with whole shopping malls shutting down across the US. This is not due to the small shift in shopping patterns by consumers going online, even though this is what the mainstream media tells us. Yes, many people shop online, with the number seemingly significant, but when compared to normal shopping channels (shops), online only represents around 12% of total sales.

There are many other factors which I will write about in another article, relating to hedge funds that strip decent companies just as Gordon Gecko did in the film Wall Street. The main reason shops are closing is due to the fact that people don't have as much money to spend as they had in the past. This is a global phenomenon as real wages haven't risen for over two decades for the majority of people.

When will the bubble burst?

I believe as I write this article in March 2020 that it already has. However, it has nothing to do with the global economic downturn "caused" by coronavirus/covid19. This is being used as a fake narrative to mask the real reasons economies are in trouble. We already see charts from financial institutions and the mainstream media calling this the "Covid19 Crash".....rather than "The Everything Bubble" caused by The Federal Reserve and other central banks.

For the first time in 30 years, China has recently bailed out a total of four banks and taken over their control being quietly nationalized as occurred to RBS in the UK.

Chinese savers, like those of Northern Rock, lined the streets for days to withdraw their cash. They recognised that to trust the government to cover any losses is a fake narrative when in essence you are dealing with a collapsing Ponzi scheme.

The only way to guarantee your money, is to queue up and take it out yourself before others do.

House prices in Australia that had been rising for 28 years, have been dropping for many months. In Dubai prices have dropped back to 2008 levels. Other parts of the world including London, San Francisco, Bangkok and Vancouver, to name only a few, are also declining. Luxury apartments in downtown Manhattan, New York are in over-supply and not selling at all.

In the UK, the historical metric used to take out a mortgage was 3-4 times an individual's salary. In 2020, many if not most mortgages are at the 4.5 multiple level, with some lenders willing to stretch to 5.5-6.0 times salary. The level of the cash deposit required has also in some cases shot up to a huge 25% down payment. This is just one tiny element pushing property prices up.

We hear the media talking about the 1%....this is another fake narrative as it includes doctors, lawyers, business owners etc. which are the upper middle classes. The vast majority of the gains over the past two decades have flowed to the top 0.001%, known as the global elite. Their incomes in various formats have gone through the roof. They earn tens to hundreds of millions per year.....these are the predators that pull the economic strings, hidden behind a curtain.....just like the Wizard of Oz!

Many, if not most households have both people working to either maintain their standard of living as costs rise or to try to get ahead. All western currencies have lost their purchasing power over the past century. The US dollar, the current reserve currency of the world, has lost 96% of its value since 1913. This debasement of a currency is a slow burner, but has had a devastating effect over the years in all currencies.

One strange effect of the recent global stock market crashes, has been that the US Dollar has increased in value relative to other currencies. This is because it is the reserve currency of the world and countries are rushing to purchase a "secure" currency while theirs crash. I have experienced this myself in my short 3 weeks in Mexico. The value of the Mexican Peso has dropped by 20%, making my purchases significantly cheaper as a foreigner, for locals however, tough times have begun.

Inflation

Inflation is the real enemy, the silent destroyer of wealth which chips away at an official 2% per year. But many shoppers know this is not the real inflation rate. The price of many items may have remained the same compared to a few years ago, but their size has shrunk. Take for example a tin of tuna from a UK supermarket, which I know for a fact as it had been a weekly shopping item. The contents have shrunk every year, what used to be a 250g tin is now down to 160g, 130g and 112g, but the price is the same! Actually, my tin of tuna has gone up in price by about 20% per year. How about buying bags of crisps, chocolate and especially the famous UK Christmas Box Selections which have become smaller and smaller over the years.

The real inflation rate is closer to 7%.....yes 7%, not what we are told on TV. This means you have to receive an annual pay rise of this magnitude just to break even. Some of the better jobs may track the official inflation rate of around 2%, but most do not.

The reality is that the working and middle classes have been slowly destroyed over the past 20 years and have not been making any progress in life with their standard of living going backwards. Cheap televisions, gadgets and some holiday destinations mask the reality of what is really going on.

It has been common in Japan for families to take out 100 year mortgages for a long time. These are then handed down to their children. I can't imagine handing down a debt to a child wrapped up as an inheritance.....crazy times. This may also happen in the west in the future.

As I have shown, there is not just one bubble waiting to burst, but multiple ones. In the US we now have sub-prime car loans. These are thousands of loans that are packaged into a financial product and sold on to other institutions by the originator. Just as in the previous 2008 recession, these loans have many bad elements within them, which could and probably will crash everything. This isn't limited to the US however, France and Germany have issued most of these products which are called derivatives.

You may ask, why do these financial institutions continue to create these derivative products, the answer is quite simple, they earn huge fees from them. But the real beauty is that these products called CDOs, are sold on to other institutions that are desperate to earn a yield (interest/money). These are more often than not, pension funds that have promised to return 7% per annum to pensioners. This in a global environment where interest rates are under one half of 1%.

At some point as in 2008, institutions at the end of the food chain, will realize what is going on and try to offload these CDOs to other institutions. That's when it crashes, because the really clued up institutions understand what's going on.

We also have some fund managers like the Woodford Equity Income Fund, which refused to return investors money. Think about that for a moment, it's your money but you can't get it back, this has happened to a few local authority pension schemes in the UK recently. The fund has now shut down and investors got back between 46-57% of their original investment.

The IMF recently predicted a 100% risk for sovereign debt failure. What does this mean, it means that governments and countries are likely to be unable to pay back loans they have taken out.

What Should I Do?

This is not easy to answer, everybody has different circumstances and I am not a financial advisor; I can only tell you what I have done.

I remember many decades ago, coal miners in Wales had lost their company pensions, many of which had been paying into for 20, 30 and 40 years. The government eventually stepped in. I remember thinking that with something as stable as my pension, I would also have to think about and not give away responsibility to another institution.

I have decided to sell my apartment in London and will not be purchasing another property for the foreseeable future. I will wait for the next global property crash to run its course before investing again.

I also withdrew and diversified away from the stock market, cashing in shares and changing the direction of my pension plan.

If you are fortunate enough to have cash in a bank account, many people are unaware that they are an unsecured creditor on the bank's balance sheet. Yes, many countries have a government backed scheme to protect your money. This is however only theoretical, if many banks collapse at the same time, as nearly happened in 2008, the government would not be able to bail everyone out.

You only need to look at what happened in Cyprus a few years ago where small businesses with cash in bank accounts had to take a "haircut". What does this mean? A small business with €100,000 in the bank ended up losing 20%.

It was as simple as that, the Cyprus Government passed legislation and businesses lost 20% from their bank accounts. Government legislation has secretly been put in place allowing banks in all EU countries to do the same as Cyprus.

What does this ultimately mean to a small business owner? Governments (which are very cosy with big corporations and especially the banks), want you to pay for their mistakes. But the fact is, they are not mistakes, everything has been designed for a certain outcome. You only need to read what happened to the business interests of Noel Edmonds and other small businesses. The famous TV presenter has been battling for years the corrupt banking sector.

In the UK and other parts of the world, is it a coincidence that we have endured financial scandal after financial scandal. The financial institutions when caught mis-selling a product or service always claim it to be a mistake and failure of their systems. They then sometimes pay a huge fine which tends to be a fraction of the money they earned from their scam.

And yes, it is a scam. If you ever follow these cases, no-one ever goes to prison apart from a rare occasion when a low-level trader is made the scapegoat. The incentive to fleece people has zero consequence for high level management. Through their actions, Banks and Banker's are now being referred to as Banksters'.

The day of the friendly village banker disappeared a long time ago.

The banking giants around the world are nothing more than legal crooks. If you're still not convinced, research for yourself to see how money is really created, or go over to my

questions website to see the answer (in the economics section). Banksters' is too good a word for these modern-day robber barons.

The following examples from the UK, demonstrate these institutions are systematic in creating new financial products & services which benefit themselves to the detriment of the general public.

- Payment Protection Insurance (PPI)

- Interest Rates (LIBOR)

- Royal Bank of Scotland (RBS)

- Foreign Exchange Rates

- Mortgage Insurance

- Loan Insurance

- Payday Loans

- Packaged Lifestyle Bank Accounts

- Pensions Marketing

- Overdraft Charges

- Credit Card Protection Insurance

- Mortgage Marketing

How many more examples in the UK and around the world are we likely to see over the coming decades, where ordinary hard working people are scammed by the elite class!

With this next global crash, which some are speculating naming it "The Greatest Depression", we are likely to see a hyperinflation period lasting many years. You only need to look Zimbabwe and currently Venezuela. Prices of all goods and services are likely to rise exponentially. I got to experience this first-hand while in Argentina. My cup of coffee at my local coffee shop rose in price by 5.4% over the four weeks I was there, this equates to over 50% per year inflation.

The current virus scare has shown that people panic buy everything. When times calm down, it may be prudent to stock up on some essentials as prices go up and supplies dwindle.

All my research leads me to believe we are heading for a very difficult time globally, I hope I'm wrong. I think that the only flaw to my detailed research may be the timing.....time will tell.

HOMEPAGE

Get in touch

If you have any comments, questions or just want to say hello.....let's chat

Let's go back in time to The Dutch Tulip Bubble from the mid 1600s as an example. During this time, a single tulip bulb, a flower, was worth the same as a home.....yes a whole house. Tulip mania had taken hold and swept throughout Holland.

Clearly this was not based on any form of reality, but investors, or better yet, let's call them speculators, were sucked in, hoping to realize surreal profits and get out before the next person. Many were aware it was a bubble, but took the risk regardless, as the stories of becoming super rich, reached fever pitch. At the time, the price of bulbs could only go up in the eyes of everyone......until the bubble burst, and most were left with nothing.

A similar story before the great depression of the 1930s, is said to go something like this.

Let's go back in time to The Dutch Tulip Bubble from the mid 1600s as an example. During this time, a single tulip bulb, a flower, was worth the same as a home.....yes a whole house. Tulip mania had taken hold and swept throughout Holland.

Clearly this was not based on any form of reality, but investors, or better yet, let's call them speculators, were sucked in, hoping to realize surreal profits and get out before the next person. Many were aware it was a bubble, but took the risk regardless, as the stories of becoming super rich, reached fever pitch. At the time, the price of bulbs could only go up in the eyes of everyone......until the bubble burst, and most were left with nothing.

A similar story before the great depression of the 1930s, is said to go something like this. A Wall Street Stockbroker was having his shoes polished by a shoe shine boy on a street corner, the boy then proceeded to give the stockbroker share tips! The current bubble may not seem as crazy or extreme, but it is likely to affect more people, ordinary people. The working and middle classes, investors, homeowners, pensioners and anyone who is fortunate to have savings in one form or another.

This Everything Bubble includes: property, stocks, bonds, artworks, fine wine, classic cars, modern hyper-cars (if ever there was a truer term!) and yachts etc.

All these assets have increased in value disproportionately in recent years – I believe things have begun to change.

A Wall Street Stockbroker was having his shoes polished by a shoe shine boy on a street corner, the boy then proceeded to give the stockbroker share tips! The current bubble may not seem as crazy or extreme, but it is likely to affect more people, ordinary people. The working and middle classes, investors, homeowners, pensioners and anyone who is fortunate to have savings in one form or another.

This Everything Bubble includes: property, stocks, bonds, artworks, fine wine, classic cars, modern hyper-cars (if ever there was a truer term!) and yachts etc.

All these assets have increased in value disproportionately in recent years – I believe things have begun to change.

It doesn't matter if performance is up or down, articles will be written to convince investors to stay invested. You might think, okay, if performance is down during one or two quarters it doesn't really matter. But what happens when performance is down for 2, 3 or even 5 years and articles are still being written to convince the pension funds to stay. Remember, pension funds are a pool of the money of ordinary people like you and me, our monthly payments go towards these pension funds to fund our retirement. I will be writing an article about pension funds in the future.

As I often tell people, the 2008 global crash was just the starter/appetizer course. The problems that caused the 2008 crash were never solved but instead the can has been kicked down the road for the past 12 years. We have yet to experience the main course of a global crash that will make 2008 look like a mere blip. The next crash is likely to dwarf the Great Depression of the 1930s, unfortunately, it will be very ugly. Some alternative financial analysts are predicting stock market crashes of up to 80-90%.....recent huge crashes could merely be the beginning.

The Federal Reserve and other central banks around the world have been propping up stock markets for the past 12 years. Ask yourself, why have they needed to do this if economies were healthy rather than on the verge of collapse?

There will be a point when stock markets function normally, unlike the past 12 years, and reflect reality where there will be no buyers for stocks, bonds and other financial products as they reflect their real value and not the induced bubble by central banks around the world.

If you have any doubts that this is true, a recent University study showed that 93% of the US Stock Market rise is directly attributable to interference by the US Federal Reserve.

At the beginning of the 2008 crash, the top global investment banks of the world ran to the US Government asking it to prop up the financial system. We were told, it was to the tune of billions of dollars, the truer undisclosed number was in the trillions. It's hard to even think how many zeros that is.

This money was supposed to be used by the banks to lend to businesses, particularly SMEs (small & medium enterprises), and push economies forward. Instead, most of this money stayed with the big investment banks and only went to some very large corporations and not the small "mom & pop" enterprises. When you look at the statistics, SMEs, account for approximately 90% of jobs and therefore the force that powers economies forward in most countries.

Presently in March 2020, The Federal Reserve is up to its old tricks yet again, pumping trillions of US dollars to its friends within the Investment Banking & Hedge Fund industries. The recent dramatic stock market collapses have exposed these institutions and how The Federal Reserve gives priority to its friends and owners on Wall Street over small businesses and

ordinary people on Main Street. It may surprise you to learn that The Federal Reserve is not Federal and not part of the US Government, but a privately owned institution.

The central banks of the world; The Bank of England, The Federal Reserve, The European Central Bank, and The Bank of Japan have been printing lots of money for over a decade. This money printing or quantitative easing as they refer to it, had the consequence of exploding asset prices but also devaluing the money in circulation.

Stock markets have increased substantially over the past 12 years by this artificial propping up of global economies. On the surface and by that I mean, in the mainstream media – the televised news and newspapers, the economies and health of most countries seem to be doing very well. But economies globally are overdue a massive correction.

In reality, SMEs in particular, are struggling as they are unable to raise finance to help with future growth.

The lowest interest rates we have seen for the last 5,000 years, have also led to corporations borrowing billions upon billions very cheaply. Much of this money has gone into property in many countries around the world. This is sometimes referred to as the Skyscraper Index.

Many of us have witnessed an extraordinary number of cranes in big cities with companies building apartments everywhere they can. This has certainly been true during the 14 months I spent in South East Asia.

It doesn't matter if performance is up or down, articles will be written to convince investors to stay invested. You might think, okay, if performance is down during one or two quarters it doesn't really matter. But what happens when performance is down for 2, 3 or even 5 years and articles are still being written to convince the pension funds to stay. Remember, pension funds are a pool of the money of ordinary people like you and me, our monthly payments go towards these pension funds to fund our retirement. I will be writing an article about pension funds in the future.

As I often tell people, the 2008 global crash was just the starter/appetizer course. The problems that caused the 2008 crash were never solved but instead the can has been kicked down the road for the past 12 years. We have yet to experience the main course of a global crash that will make 2008 look like a mere blip. The next crash is likely to dwarf the Great Depression of the 1930s, unfortunately, it will be very ugly. Some alternative financial analysts are predicting stock market crashes of up to 80-90%.....recent huge crashes could merely be the beginning.

The Federal Reserve and other central banks around the world have been propping up stock markets for the past 12 years. Ask yourself, why have they needed to do this if economies were healthy rather than on the verge of collapse?

There will be a point when stock markets function normally, unlike the past 12 years, and reflect reality where there will be no buyers for stocks, bonds and other financial products as they reflect their real value and not the induced bubble by central banks around the world.

If you have any doubts that this is true, a recent University study showed that 93% of the US Stock Market rise is directly attributable to interference by the US Federal Reserve.

At the beginning of the 2008 crash, the top global investment banks of the world ran to the US Government asking it to prop up the financial system. We were told, it was to the tune of billions of dollars, the truer undisclosed number was in the trillions. It's hard to even think how many zeros that is.

This money was supposed to be used by the banks to lend to businesses, particularly SMEs (small & medium enterprises), and push economies forward. Instead, most of this money stayed with the big investment banks and only went to some very large corporations and not the small "mom & pop" enterprises. When you look at the statistics, SMEs, account for approximately 90% of jobs and therefore the force that powers economies forward in most countries.

Presently in March 2020, The Federal Reserve is up to its old tricks yet again, pumping trillions of US dollars to its friends within the Investment Banking & Hedge Fund industries. The recent dramatic stock market collapses have exposed these institutions and how The Federal Reserve gives priority to its friends and owners on Wall Street over small businesses and

ordinary people on Main Street. It may surprise you to learn that The Federal Reserve is not Federal and not part of the US Government, but a privately owned institution.

The central banks of the world; The Bank of England, The Federal Reserve, The European Central Bank, and The Bank of Japan have been printing lots of money for over a decade. This money printing or quantitative easing as they refer to it, had the consequence of exploding asset prices but also devaluing the money in circulation.

Stock markets have increased substantially over the past 12 years by this artificial propping up of global economies. On the surface and by that I mean, in the mainstream media – the televised news and newspapers, the economies and health of most countries seem to be doing very well. But economies globally are overdue a massive correction.

In reality, SMEs in particular, are struggling as they are unable to raise finance to help with future growth.

The lowest interest rates we have seen for the last 5,000 years, have also led to corporations borrowing billions upon billions very cheaply. Much of this money has gone into property in many countries around the world. This is sometimes referred to as the Skyscraper Index.

Many of us have witnessed an extraordinary number of cranes in big cities with companies building apartments everywhere they can. This has certainly been true during the 14 months I spent in South East Asia. All the big cities are building like crazy; Singapore, Kuala Lumpur, Bangkok, Phnom Penh, Manila and Jakarta. This is one consequence of cheap money, big businesses borrow big money to convert into large profits. There is only one problem, property globally is in an oversupply situation with a few exceptions, notably Singapore and Hong Kong.

As individuals, we have also taken advantage of low interest rates to borrow more in the form of loans and mortgages which have attractive low monthly payments. This has led to massive levels of consumption mostly through credit cards but also people re-mortgaging their homes in order to invest in further properties to rent out. Pension annuity levels have decreased substantially over the past two decades, leading pensioners to seek alternative higher yielding returns, unfortunately with higher risk levels. It is no coincidence that personal debt worldwide is at its highest level for 20 years. Having too much personal debt never ends well, especially when an economy goes into a decline and people begin to lose their jobs.

We have also been experiencing negative interest rates for the longest period since records began. The result is that it's not worth putting your money into a bank as they are charging you to look after it.

All the big cities are building like crazy; Singapore, Kuala Lumpur, Bangkok, Phnom Penh, Manila and Jakarta. This is one consequence of cheap money, big businesses borrow big money to convert into large profits. There is only one problem, property globally is in an oversupply situation with a few exceptions, notably Singapore and Hong Kong.

As individuals, we have also taken advantage of low interest rates to borrow more in the form of loans and mortgages which have attractive low monthly payments. This has led to massive levels of consumption mostly through credit cards but also people re-mortgaging their homes in order to invest in further properties to rent out. Pension annuity levels have decreased substantially over the past two decades, leading pensioners to seek alternative higher yielding returns, unfortunately with higher risk levels. It is no coincidence that personal debt worldwide is at its highest level for 20 years. Having too much personal debt never ends well, especially when an economy goes into a decline and people begin to lose their jobs.

We have also been experiencing negative interest rates for the longest period since records began. The result is that it's not worth putting your money into a bank as they are charging you to look after it.

While on the surface for those taking out a mortgage, negative interest rates are a boon, as you can buy a property with the lender charging very low rates for the loan. The lenders only need to raise interest rates by 2-3% and hundreds of thousands, if not millions of homeowners will be repossessed.

We also have the crazy situation with some countries issuing 20-30 year bonds which do not pay the investor any interest at all. Let that sink in, you hand over your hard-earned money to your government with zero return for 20-30 years.

Corporate buybacks (where companies buy back their own shares) have been used by senior management to give themselves huge bonuses based on a rising share price as fewer shares are in circulation. This is another reason that stock markets are at an all-time high. Apart from a few huge corporations, the majority are less profitable than in the past, they appear healthy but are far from it because they are not investing for future growth. In fact, some of the biggest (Apple, Microsoft & Berkshire Hathaway) are hording cash as they know what is about to happen and will go on a buying spree to snap up companies for a fraction of their current share price once stock markets crash.

There are many companies that should no longer be trading based on market fundamentals. Tesla, were it not for hundreds of billions of dollars in government subsidies, doesn't really have a viable business model. Somehow it is more valuable than all the major US vehicle manufacturers combined! Financial analyst's are now speaking up about this.

Another metric used to determine how healthy large corporations are, is to look at the likelihood of them paying back borrowed money. Prior to the 2008 crash – 35% of investment-grade corporate bonds, as they are known, were rated BBB, which is just one level above junk status. Presently that number is 50%.

Deutsch Bank has shed 10,000s of employees globally and could be on the verge of collapsing. It has a derivatives position (bets), valued at €45 trillion....with a "t" not "b" as in billions. This equates to 12 times the output of the whole German economy in one year.....what could possibly go wrong?

If the bank were due to collapse, I'm sure the German government would come in and save the day simply because the bank is named after Germany! Another bank that has similar problems is HSBC. These are a couple of the big boys in banking, many less well known banks are equally in trouble, which one will be the next Lehman Brothers (where I spent many years, prior to them being taken out) remains to be seen.

IPOs (Initial Public Offerings), where a company is placed onto a stock market for the first time, are popular again. Uber and Lyft were recent floats, with Airbnb set to launch later in 2020. One problem, just like the previous tech bubble, most of these companies are losing tons of money.....billions per year. The private investors that put billions upon billions into these companies want their money back. The only way to do this, is to float these businesses on stock markets before they crash and lose all their investment.

Uber has been losing billions every year since it started as it has to give huge incentives to drivers, leading to huge losses in developing new markets.

We also have fake beef, a company that has created artificial beef in a laboratory that has US$29 million in profits but valued at a crazy US$39 billion.

The historic way of sorting the good companies from the bad, was abandoned a long time ago, with traditional accounting standards ignored. This will end in the same way as the Tech Crash (dot-com bubble) of 2000.

While on the surface for those taking out a mortgage, negative interest rates are a boon, as you can buy a property with the lender charging very low rates for the loan. The lenders only need to raise interest rates by 2-3% and hundreds of thousands, if not millions of homeowners will be repossessed.

We also have the crazy situation with some countries issuing 20-30 year bonds which do not pay the investor any interest at all. Let that sink in, you hand over your hard-earned money to your government with zero return for 20-30 years.

Corporate buybacks (where companies buy back their own shares) have been used by senior management to give themselves huge bonuses based on a rising share price as fewer shares are in circulation. This is another reason that stock markets are at an all-time high. Apart from a few huge corporations, the majority are less profitable than in the past, they appear healthy but are far from it because they are not investing for future growth. In fact, some of the biggest (Apple, Microsoft & Berkshire Hathaway) are hording cash as they know what is about to happen and will go on a buying spree to snap up companies for a fraction of their current share price once stock markets crash.

There are many companies that should no longer be trading based on market fundamentals. Tesla, were it not for hundreds of billions of dollars in government subsidies, doesn't really have a viable business model. Somehow it is more valuable than all the major US vehicle manufacturers combined! Financial analyst's are now speaking up about this.

Another metric used to determine how healthy large corporations are, is to look at the likelihood of them paying back borrowed money. Prior to the 2008 crash – 35% of investment-grade corporate bonds, as they are known, were rated BBB, which is just one level above junk status. Presently that number is 50%.

Deutsch Bank has shed 10,000s of employees globally and could be on the verge of collapsing. It has a derivatives position (bets), valued at €45 trillion....with a "t" not "b" as in billions. This equates to 12 times the output of the whole German economy in one year.....what could possibly go wrong?

If the bank were due to collapse, I'm sure the German government would come in and save the day simply because the bank is named after Germany! Another bank that has similar problems is HSBC. These are a couple of the big boys in banking, many less well known banks are equally in trouble, which one will be the next Lehman Brothers (where I spent many years, prior to them being taken out) remains to be seen.

IPOs (Initial Public Offerings), where a company is placed onto a stock market for the first time, are popular again. Uber and Lyft were recent floats, with Airbnb set to launch later in 2020. One problem, just like the previous tech bubble, most of these companies are losing tons of money.....billions per year. The private investors that put billions upon billions into these companies want their money back. The only way to do this, is to float these businesses on stock markets before they crash and lose all their investment.

Uber has been losing billions every year since it started as it has to give huge incentives to drivers, leading to huge losses in developing new markets.

We also have fake beef, a company that has created artificial beef in a laboratory that has US$29 million in profits but valued at a crazy US$39 billion.

The historic way of sorting the good companies from the bad, was abandoned a long time ago, with traditional accounting standards ignored. This will end in the same way as the Tech Crash (dot-com bubble) of 2000.

The situation in Japan is farcical. The Japanese Government owns over 5% of the Nikkei Stock Market. In other words, it is the top shareholder in over 23 companies, this is close to 40% of all listed companies on the Nikkei. This is not based on any form of economic reality and likely not last for much longer, despite having been in place for the past 10 years.

Many retailers are closing their doors and shutting down at shocking rates. Macy's alone will be closing 125 locations, cutting 2,000 jobs, they are not alone, with whole shopping malls shutting down across the US. This is not due to the small shift in shopping patterns by consumers going online, even though this is what the mainstream media tells us. Yes, many people shop online, with the number seemingly significant, but when compared to normal shopping channels (shops), online only represents around 12% of total sales.

There are many other factors which I will write about in another article, relating to hedge funds that strip decent companies just as Gordon Gecko did in the film Wall Street. The main reason shops are closing is due to the fact that people don't have as much money to spend as they had in the past. This is a global phenomenon as real wages haven't risen for over two decades for the majority of people.

The situation in Japan is farcical. The Japanese Government owns over 5% of the Nikkei Stock Market. In other words, it is the top shareholder in over 23 companies, this is close to 40% of all listed companies on the Nikkei. This is not based on any form of economic reality and likely not last for much longer, despite having been in place for the past 10 years.

Many retailers are closing their doors and shutting down at shocking rates. Macy's alone will be closing 125 locations, cutting 2,000 jobs, they are not alone, with whole shopping malls shutting down across the US. This is not due to the small shift in shopping patterns by consumers going online, even though this is what the mainstream media tells us. Yes, many people shop online, with the number seemingly significant, but when compared to normal shopping channels (shops), online only represents around 12% of total sales.

There are many other factors which I will write about in another article, relating to hedge funds that strip decent companies just as Gordon Gecko did in the film Wall Street. The main reason shops are closing is due to the fact that people don't have as much money to spend as they had in the past. This is a global phenomenon as real wages haven't risen for over two decades for the majority of people.

The only way to guarantee your money, is to queue up and take it out yourself before others do.

House prices in Australia that had been rising for 28 years, have been dropping for many months. In Dubai prices have dropped back to 2008 levels. Other parts of the world including London, San Francisco, Bangkok and Vancouver, to name only a few, are also declining. Luxury apartments in downtown Manhattan, New York are in over-supply and not selling at all.

In the UK, the historical metric used to take out a mortgage was 3-4 times an individual's salary. In 2020, many if not most mortgages are at the 4.5 multiple level, with some lenders willing to stretch to 5.5-6.0 times salary. The level of the cash deposit required has also in some cases shot up to a huge 25% down payment. This is just one tiny element pushing property prices up.

We hear the media talking about the 1%....this is another fake narrative as it includes doctors, lawyers, business owners etc. which are the upper middle classes. The vast majority of the gains over the past two decades have flowed to the top 0.001%, known as the global elite. Their incomes in various formats have gone through the roof. They earn tens to hundreds of millions per year.....these are the predators that pull the economic strings, hidden behind a curtain.....just like the Wizard of Oz!

Many, if not most households have both people working to either maintain their standard of living as costs rise or to try to get ahead. All western currencies have lost their purchasing power over the past century. The US dollar, the current reserve currency of the world, has lost 96% of its value since 1913. This debasement of a currency is a slow burner, but has had a devastating effect over the years in all currencies.

One strange effect of the recent global stock market crashes, has been that the US Dollar has increased in value relative to other currencies. This is because it is the reserve currency of the world and countries are rushing to purchase a "secure" currency while theirs crash. I have experienced this myself in my short 3 weeks in Mexico. The value of the Mexican Peso has dropped by 20%, making my purchases significantly cheaper as a foreigner, for locals however, tough times have begun.

The only way to guarantee your money, is to queue up and take it out yourself before others do.

House prices in Australia that had been rising for 28 years, have been dropping for many months. In Dubai prices have dropped back to 2008 levels. Other parts of the world including London, San Francisco, Bangkok and Vancouver, to name only a few, are also declining. Luxury apartments in downtown Manhattan, New York are in over-supply and not selling at all.

In the UK, the historical metric used to take out a mortgage was 3-4 times an individual's salary. In 2020, many if not most mortgages are at the 4.5 multiple level, with some lenders willing to stretch to 5.5-6.0 times salary. The level of the cash deposit required has also in some cases shot up to a huge 25% down payment. This is just one tiny element pushing property prices up.

We hear the media talking about the 1%....this is another fake narrative as it includes doctors, lawyers, business owners etc. which are the upper middle classes. The vast majority of the gains over the past two decades have flowed to the top 0.001%, known as the global elite. Their incomes in various formats have gone through the roof. They earn tens to hundreds of millions per year.....these are the predators that pull the economic strings, hidden behind a curtain.....just like the Wizard of Oz!

Many, if not most households have both people working to either maintain their standard of living as costs rise or to try to get ahead. All western currencies have lost their purchasing power over the past century. The US dollar, the current reserve currency of the world, has lost 96% of its value since 1913. This debasement of a currency is a slow burner, but has had a devastating effect over the years in all currencies.

One strange effect of the recent global stock market crashes, has been that the US Dollar has increased in value relative to other currencies. This is because it is the reserve currency of the world and countries are rushing to purchase a "secure" currency while theirs crash. I have experienced this myself in my short 3 weeks in Mexico. The value of the Mexican Peso has dropped by 20%, making my purchases significantly cheaper as a foreigner, for locals however, tough times have begun.

The reality is that the working and middle classes have been slowly destroyed over the past 20 years and have not been making any progress in life with their standard of living going backwards. Cheap televisions, gadgets and some holiday destinations mask the reality of what is really going on.

It has been common in Japan for families to take out 100 year mortgages for a long time. These are then handed down to their children. I can't imagine handing down a debt to a child wrapped up as an inheritance.....crazy times. This may also happen in the west in the future.

As I have shown, there is not just one bubble waiting to burst, but multiple ones. In the US we now have sub-prime car loans. These are thousands of loans that are packaged into a financial product and sold on to other institutions by the originator. Just as in the previous 2008 recession, these loans have many bad elements within them, which could and probably will crash everything. This isn't limited to the US however, France and Germany have issued most of these products which are called derivatives.

You may ask, why do these financial institutions continue to create these derivative products, the answer is quite simple, they earn huge fees from them. But the real beauty is that these products called CDOs, are sold on to other institutions that are desperate to earn a yield (interest/money). These are more often than not, pension funds that have promised to return 7% per annum to pensioners. This in a global environment where interest rates are under one half of 1%.

At some point as in 2008, institutions at the end of the food chain, will realize what is going on and try to offload these CDOs to other institutions. That's when it crashes, because the really clued up institutions understand what's going on.

We also have some fund managers like the Woodford Equity Income Fund, which refused to return investors money. Think about that for a moment, it's your money but you can't get it back, this has happened to a few local authority pension schemes in the UK recently. The fund has now shut down and investors got back between 46-57% of their original investment.

The IMF recently predicted a 100% risk for sovereign debt failure. What does this mean, it means that governments and countries are likely to be unable to pay back loans they have taken out.

The reality is that the working and middle classes have been slowly destroyed over the past 20 years and have not been making any progress in life with their standard of living going backwards. Cheap televisions, gadgets and some holiday destinations mask the reality of what is really going on.

It has been common in Japan for families to take out 100 year mortgages for a long time. These are then handed down to their children. I can't imagine handing down a debt to a child wrapped up as an inheritance.....crazy times. This may also happen in the west in the future.

As I have shown, there is not just one bubble waiting to burst, but multiple ones. In the US we now have sub-prime car loans. These are thousands of loans that are packaged into a financial product and sold on to other institutions by the originator. Just as in the previous 2008 recession, these loans have many bad elements within them, which could and probably will crash everything. This isn't limited to the US however, France and Germany have issued most of these products which are called derivatives.

You may ask, why do these financial institutions continue to create these derivative products, the answer is quite simple, they earn huge fees from them. But the real beauty is that these products called CDOs, are sold on to other institutions that are desperate to earn a yield (interest/money). These are more often than not, pension funds that have promised to return 7% per annum to pensioners. This in a global environment where interest rates are under one half of 1%.

At some point as in 2008, institutions at the end of the food chain, will realize what is going on and try to offload these CDOs to other institutions. That's when it crashes, because the really clued up institutions understand what's going on.

We also have some fund managers like the Woodford Equity Income Fund, which refused to return investors money. Think about that for a moment, it's your money but you can't get it back, this has happened to a few local authority pension schemes in the UK recently. The fund has now shut down and investors got back between 46-57% of their original investment.

The IMF recently predicted a 100% risk for sovereign debt failure. What does this mean, it means that governments and countries are likely to be unable to pay back loans they have taken out.

It was as simple as that, the Cyprus Government passed legislation and businesses lost 20% from their bank accounts. Government legislation has secretly been put in place allowing banks in all EU countries to do the same as Cyprus.

What does this ultimately mean to a small business owner? Governments (which are very cosy with big corporations and especially the banks), want you to pay for their mistakes. But the fact is, they are not mistakes, everything has been designed for a certain outcome. You only need to read what happened to the business interests of Noel Edmonds and other small businesses. The famous TV presenter has been battling for years the corrupt banking sector.

In the UK and other parts of the world, is it a coincidence that we have endured financial scandal after financial scandal. The financial institutions when caught mis-selling a product or service always claim it to be a mistake and failure of their systems. They then sometimes pay a huge fine which tends to be a fraction of the money they earned from their scam.

And yes, it is a scam. If you ever follow these cases, no-one ever goes to prison apart from a rare occasion when a low-level trader is made the scapegoat. The incentive to fleece people has zero consequence for high level management. Through their actions, Banks and Banker's are now being referred to as Banksters'.

It was as simple as that, the Cyprus Government passed legislation and businesses lost 20% from their bank accounts. Government legislation has secretly been put in place allowing banks in all EU countries to do the same as Cyprus.

What does this ultimately mean to a small business owner? Governments (which are very cosy with big corporations and especially the banks), want you to pay for their mistakes. But the fact is, they are not mistakes, everything has been designed for a certain outcome. You only need to read what happened to the business interests of Noel Edmonds and other small businesses. The famous TV presenter has been battling for years the corrupt banking sector.

In the UK and other parts of the world, is it a coincidence that we have endured financial scandal after financial scandal. The financial institutions when caught mis-selling a product or service always claim it to be a mistake and failure of their systems. They then sometimes pay a huge fine which tends to be a fraction of the money they earned from their scam.

And yes, it is a scam. If you ever follow these cases, no-one ever goes to prison apart from a rare occasion when a low-level trader is made the scapegoat. The incentive to fleece people has zero consequence for high level management. Through their actions, Banks and Banker's are now being referred to as Banksters'.  The day of the friendly village banker disappeared a long time ago. The banking giants around the world are nothing more than legal crooks. If you're still not convinced, research for yourself to see how money is really created, or go over to my questions website to see the answer (in the economics section). Banksters' is too good a word for these modern-day robber barons.

The following examples from the UK, demonstrate these institutions are systematic in creating new financial products & services which benefit themselves to the detriment of the general public.

The day of the friendly village banker disappeared a long time ago. The banking giants around the world are nothing more than legal crooks. If you're still not convinced, research for yourself to see how money is really created, or go over to my questions website to see the answer (in the economics section). Banksters' is too good a word for these modern-day robber barons.

The following examples from the UK, demonstrate these institutions are systematic in creating new financial products & services which benefit themselves to the detriment of the general public.